IRDAI raises age limit on health insurance: Here’s how seniors need to understand coverage, premiums and exclusions

For Dr Akash Jaiswal, keeping up with insurance plan regulations while treating his patients is a challenge. “There are a lot of ifs and buts. Sometimes after ordering a test, you will find out that it is not covered by the policy. Or there are limits on the cost and days that the person can be admitted. about them – this is a challenge for the elderly because they often need a long hospital stay. There should be policies that provide comprehensive coverage, including services such as health check-ups good with vaccines,” says a pediatrician, a health care provider for adults. Even though he works at Fortis Hospital, Gurugram, he himself had difficulties in getting proper cover for his parents.

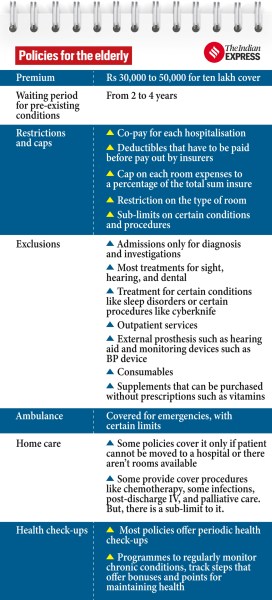

Finding health insurance for seniors is a more complicated challenge than it is meant to be. Considering their risk and vulnerability are high, and most of them have a pre-existing condition, the policies have low coverage, high premiums and long waiting periods. There are also other restrictions such as caps on treatment costs depending on specific diseases, room rent restrictions, caps on pre- and post-hospital care, OPD visits etc. With the heavy burden of out-of-pocket expenses, most of the elderly even abandon the treatment options in the middle. Now that the Insurance Regulatory and Development Authority of India (IRDAI) has asked insurance companies to offer their standard health policies to the 65-plus population, can they afford to stay longer?

HOW TO READ THE FINE PRINT

While many health insurance policies come with the fine print, senior citizen insurance comes with many co-pays and cost-sharing riders despite high premiums. The leading insurance provider’s plan, specially designed for senior citizens above 65 years, offers a cover of Rs 10 lakh at an annual premium of around Rs 34,000. “The premium goes up to Rs 45,000 if the patient has diabetes, hypertension and heart disease at the same time. There will also be a co-payment of 10%,” said a representative of Policy Bazar. asked about a new health plan for a 68-year-old with pre-existing conditions. Co-payment is the percentage of the claim that the insured patient agrees to pay out of pocket regardless of the amount of the claim. It usually varies from 10 to 30 percent.

In comparison, a healthy person in his 30s can get a cover of Rs 10 lakh with an annual premium of around Rs 10,000 without co-payment. This is in light of the fact that the Longitudinal Study of Aging in India (LASI) found that 75 percent of Indians live with at least one chronic condition.

ADDITIONS AND ILLUSTRATIONS

Most senior citizen policies come with cost-sharing clauses, offering 50 percent of the co-payment or Rs 50,000 as a deductible. So a person will have to pay 50 percent of their hospital bills while the insurance pays the rest or cough up Rs 50,000 for their healthcare before the insurance starts paying. Additional top-ups must be purchased to eliminate cost-sharing conditions, increasing insurance premiums even more.

Policies also come with limited limits for certain procedures or medical conditions. One of the policies covers payments for robotic surgery up to Rs 1 lakh, unless it is for certain conditions like cancer. However robotic surgery reduces post-operative complications and speeds up recovery. Another policy covers the cost of pain management at 20 percent of the total sum insured. This is also required by the elderly.

Reading exceptions is very important. The rules do not include new surgical procedures such as cyberknife (non-invasive radiosurgery) and radio-frequency ablation (where radiofrequency waves are delivered to certain nerves, with the aim of interrupting pain signals in the brain). They also do not involve external prostheses such as hearing aids, BP monitors or pulse oximeters. Most policies do not cover tests such as MRI (which examines changes in the organs in detail) or colonoscopy (a machine that examines the large intestine) and supplements (neutraceuticals) that can be bought without a doctor’s prescription. Dr Jaiswal says: “Very few policies cover essential physiotherapy for mobility among the elderly. The policies also do not provide universal coverage for the elderly while providing the same so the former do not choose to travel abroad.

NO OUTPATIENT, PREVENTION PROTECTION

One of the major drawbacks of health insurance policies is that they do not cover outpatient visits. “There is a need to monitor all health systems because one breakdown, say blood sugar levels, can have a detrimental effect on the overall health status,” says Dr Jaiswal.

While top-ups can be bought to cover OPD costs, they may not help, says portfolio manager Gaurav Shrivastava. “A patient would end up paying about Rs 20,000 a year but he might not end up going to the doctor that often. Adding money can be a waste,” he says.

When it comes to hospitalization, the elderly are often admitted for heart and kidney disease as well as falls and broken bones. Dr Jaiswal argues for the inclusion of preventive care such as certain examinations and vaccinations. “This can help insurers because flu and pneumonia shots may reduce hospitalizations. Preventive drugs like Dexa can help improve bone health and prevent falls,” he says. Arora advocates mental health support for the elderly as loneliness and depression are becoming major problems for them. Finally, why should we burden the elderly and not make things easier for them?

© The Indian Express Pvt Ltd

Originally Posted by: 03-05-2024 at 12:00 IST

#IRDAI #raises #age #limit #health #insurance #Heres #seniors #understand #coverage #premiums #exclusions